Multiple Choice

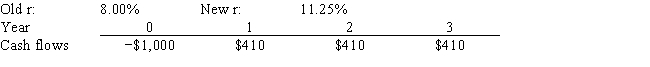

Corner Jewelers, Inc. recently analyzed the project whose cash flows are shown below. However, before the company decided to accept or reject the project, the Federal Reserve changed interest rates and therefore the firm's cost of capital (r) . The Fed's action did not affect the forecasted cash flows. By how much did the change in the r affect the project's forecasted NPV? Note that a project's expected NPV can be negative, in which case it should be rejected.

A) −$59.03

B) −$56.08

C) −$53.27

D) −$50.61

E) −$48.08

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Which of the following statements is CORRECT?

Q19: Which of the following statements is CORRECT?<br>A)

Q35: Which of the following statements is CORRECT?<br>A)

Q36: Poder Inc. is considering a project that

Q42: Hart Corp. is considering a project that

Q58: Which of the following statements is CORRECT?<br>A)

Q62: Conflicts between two mutually exclusive projects occasionally

Q64: Assume a project has normal cash flows.All

Q98: The regular payback method is deficient in

Q104: Which of the following statements is CORRECT?<br>A)