Multiple Choice

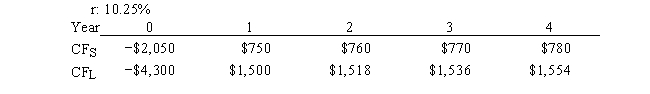

Projects S and L, whose cash flows are shown below, are mutually exclusive, equally risky, and not repeatable. Hooper Inc. is considering which of these two projects to undertake. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

A) $134.79

B) $141.89

C) $149.36

D) $164.29

E) $205.36

Correct Answer:

Verified

Correct Answer:

Verified

Q3: You are on the staff of O'Hara

Q37: The NPV and IRR methods, when used

Q48: Farmer Co. is considering Projects S and

Q49: Which of the following statements is CORRECT?<br>A)

Q49: Kiley Electronics is considering a project that

Q54: You are considering two mutually exclusive, equally

Q56: Dickson Co. is considering a project that

Q57: Langton Inc. is considering Projects S and

Q69: Lancaster Corp.is considering two equally risky, mutually

Q101: The NPV method's assumption that cash inflows