Essay

Given the following information on 3 stocks:

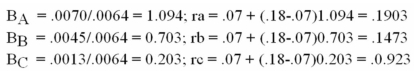

C. Which stocks would you recommend purchasing?

Indifferent on A as .1903 _.19.

Indifferent on A as .1903 _.19.

Would buy B as .15 > .1473.

Would not buy C as .09 < .0923.

Correct Answer:

Verified

Using the CAPM,calculate the expected r...

Using the CAPM,calculate the expected r...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q2: Covariance measures the interrelationship between two securities

Q7: The total number of variance and covariance

Q16: When many assets are included in a

Q21: The covariance between the IS and DS

Q24: If IS and DS are combined in

Q27: The beta of a security is calculated

Q28: The means of IS and DS are:<br>A)

Q40: Why are some risks diversifiable and some

Q52: The diversification effect of a portfolio of

Q126: The diagram below represents an opportunity set