Essay

In its 2010 annual report,Gamma Company indicated that the number of common shares held in the treasury decreased from 45,546,171 in 2009 to 3,397,381 in 2010.The following also was reported:

By Board authorization,effective December 31,2010 the Company canceled 50 million shares of common stock held in treasury.As a result of the cancellation,common stock decreased by $125 million,capital in excess of par value of stock decreased by $228 million,and retained earnings decreased by $3,119 million.

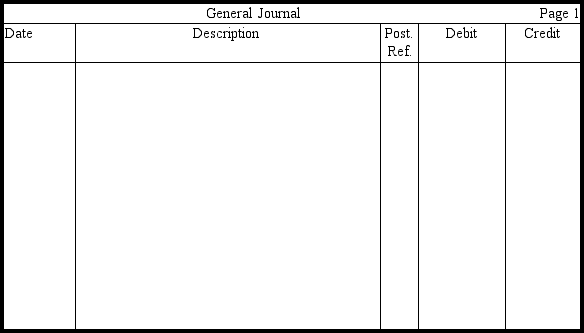

The shares canceled or retired represent almost 25 percent of the shares of common stock issued by Gamma.Explain the accounting for the treasury shares by Gamma.Did the company buy any treasury shares during the year? Prepare the entry in journal form that was made to record the cancellation or retirement of the treasury shares.At what average price were the treasury shares purchased,and at what average price were they originally issued? What do you think was management's reason for purchasing the treasury shares? (Omit explanations.)

Correct Answer:

Verified

Gamma must have purchased about 8,000,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Duncan Corporation has 2,000 shares of $100

Q30: Holders of common stock must be made

Q43: Indicate on the blanks below the net

Q56: Paloma Corporation had 5,000 shares of $100

Q56: Most preferred stocks are callable preferred stocks,which

Q102: How is it possible for a corporation

Q107: The sale of treasury stock at an

Q152: Indicate on the blanks below the net

Q153: Cash dividends become a liability of a

Q164: Use the following information to answer the