Essay

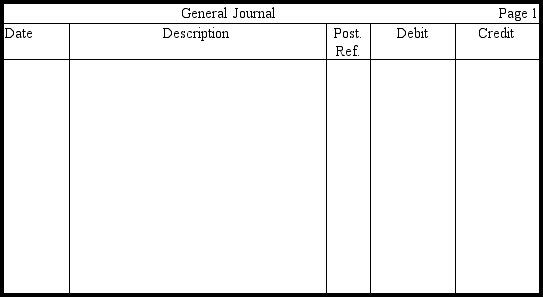

Darla Katz earns an hourly wage of $12,with time-and-a-half pay for hours worked over 40 per week.During the most recent week,she worked 46 hours,her federal tax withholding totaled $62,her state tax withholding totaled $18,and $3 was withheld for union dues.Assuming a 6.2 percent social security tax rate and a 1.45 percent Medicare tax rate,prepare the entry without explanation in the journal provided to record Katz's wages and related liabilities.Round to the nearest penny.

Correct Answer:

Verified

Correct Answer:

Verified

Q51: Heidi wishes to deposit an amount into

Q66: Hatley Corporation borrowed $10 million to finance

Q71: Use this information to answer the

Q74: Use this information to answer the

Q90: A company receives $100,of which $4

Q91: A commitment is a legal obligation that

Q142: At the time a company signs a

Q146: The higher the interest rate assumed,the<br>A)higher the

Q159: A contingent liability is recognized when the

Q172: All of the following are classified as