Essay

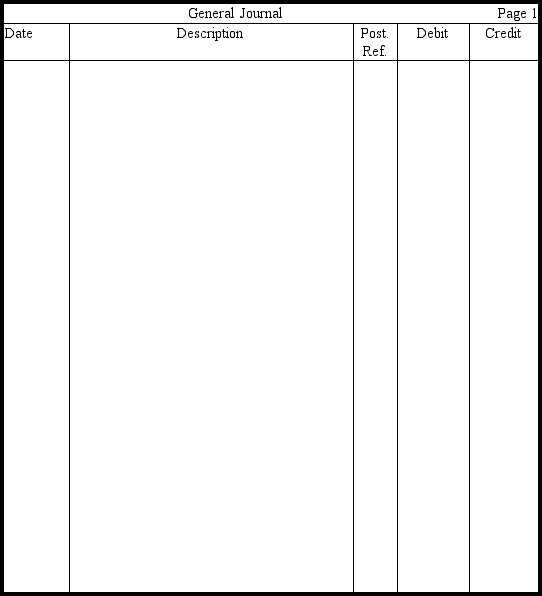

Prepare journal entries without explanations for the following transactions involving notes payable for Gomez Company,whose fiscal year ends June 30.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q19: If the net present value of a

Q34: Future value refers to an amount received

Q76: Lee Provo is paid $8 per hour,plus

Q98: Which of the following descriptions would not

Q101: A company wishes to make annual contributions

Q105: Failure to record a liability probably will<br>A)result

Q122: The entry that includes a debit to

Q144: Dividends Payable is an example of a(n)<br>A)contingent

Q151: Total payroll for a given week

Q171: Recording estimated product warranty expense in the