Essay

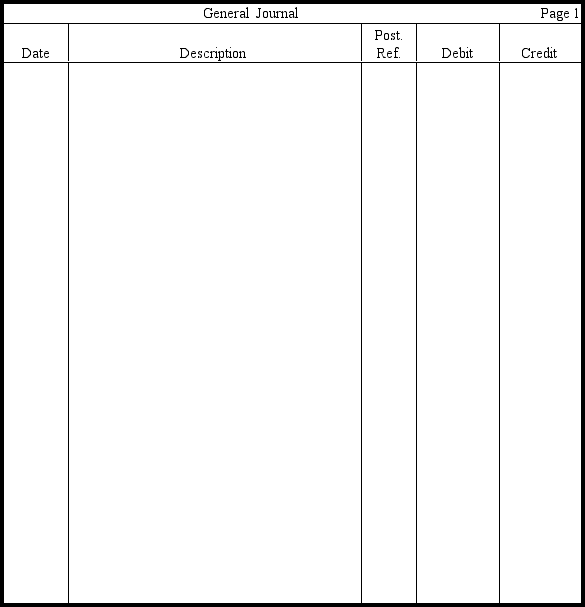

Prepare journal entries without explanations for the merchandising transactions listed below for Naveh Corporation.Assume use of the periodic inventory system.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Under the perpetual inventory system,in addition to

Q35: Use this information to answer the

Q36: Assume that the $5,509 sales made by

Q38: From the following data,calculate the amount

Q40: Use this information to answer the

Q41: Chancellor Company purchased merchandize worth $900

Q42: The income statement account balances on

Q85: Under the periodic inventory system,cost of goods

Q90: Which of the following should not be

Q150: Which of the following documents would be