Essay

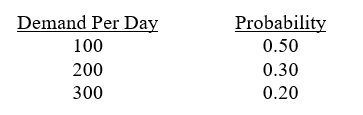

Jumbo James sells hotdogs out of a cart for $3.00 each.His cost to purchase and prepare the hotdog is $1.15 each.He operates the small business with very few capital assets and has no place to store unsold hotdogs.For this reason, every evening he sells the unsold hotdogs to a local homeless shelter for $0.50 each.Jumbo James will choose one of the following options as a standard stocking plan: d1 = 100; d2 = 150; or d3 = 200 hot dogs.On any weekday, the demand for hot dogs and the probability of selling them is estimated as follows:

a.Determine the expected value if Jumbo James stocks 200 hot dogs every day.

b.Determine the expected value if Jumbo James decides to stock 150 hot dogs every day.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Differentiate between uncertainty and risk.

Q10: _ represent a future outcome that can

Q18: A conservative or risk-averse approach to one-time

Q20: A paint company has three sources for

Q21: The following table shows cost payoffs for

Q25: A major retail clothing store is considering

Q26: Given the following table, calculate the expected

Q27: An aggressive or risk-taking approach to one-time

Q35: Making decisions in an emergency room of

Q38: Decision analysis situations often have multiple objectives.