Essay

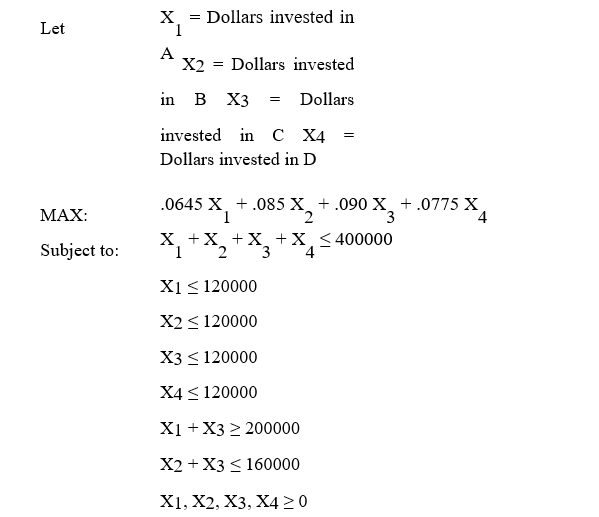

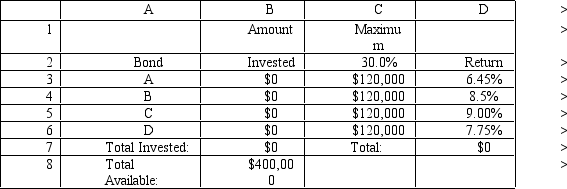

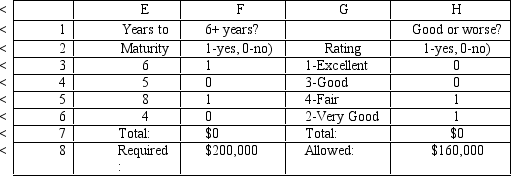

A financial planner wants to design a portfolio of investments for a client.The client has $400,000 to invest and the planner has identified four investment options for the money.The following requirements have been placed on the planner.No more than 30% of the money in any one investment,at least one half should be invested in long-term bonds which mature in six or more years,and no more than 40% of the total money should be invested in B or C since they are riskier investments.The planner has developed the following LP model based on the data in this table and the requirements of the client.The objective is to maximize the total return of the portfolio.

What formulas are required for the following cells in the Excel spreadsheet implementation of the formulation? B7

D7 F7 H7

Correct Answer:

Verified

B7 =SUMB3:B6)

D7 =SUMPRO...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

D7 =SUMPRO...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Using Data Envelopment Analysis (DEA) for an

Q27: A paper mill has received an order

Q39: Exhibit 3.5<br>The following questions are based on

Q62: State Farm Supply has just received

Q63: The hospital administrators at New Hope,County

Q68: You have been given the following

Q70: A hospital needs to determine how

Q72: An LP problem with a feasible region

Q87: Which type of spreadsheet cell represents the

Q91: Exhibit 3.3<br>The following questions are based on