Essay

An investor wants to invest $50,000 in two mutual funds,A and B.The rates of return,risks and minimum investment requirements for each fund are:

Note that a low Risk rating means a less risky investment.The investor can invest to maximize the expected rate of return or minimize risk.Any money beyond the minimum investment requirements can be invested in either fund.

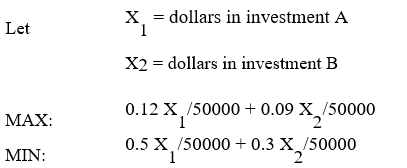

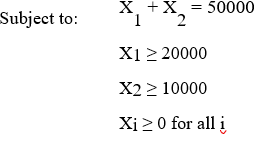

The following is the MOLP formulation for this problem:

The solution for the second LP is X1,X2)= 20,000,30,000).

What formulas should go in cells B2:D11 of the spreadsheet? NOTE: Formulas are not required in all of these cells.

Correct Answer:

Verified

Cell Formula

D6 =...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

D6 =...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Exhibit 7.1<br>The following questions are based on

Q9: A company makes 2 products A

Q12: The "triple bottom line" incorporates multiple objective

Q16: An investor wants to invest $50,000

Q17: Consider the following multi-objective linear programming problem

Q19: Suppose that X<sub>1 </sub>equals 4.What are

Q20: The RHS value of a goal constraint

Q27: Exhibit 7.2<br>The following questions are based on

Q30: Goal programming (GP) is typically<br>A) a minimization

Q48: Decision-making problems which can be stated as