Essay

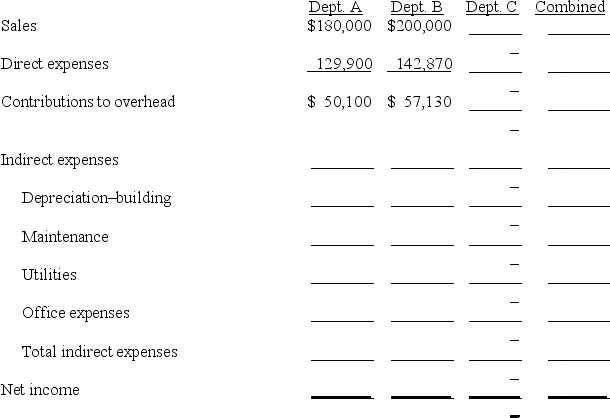

Burien,Inc.operates a retail store with two departments,A and

B. Its departmental income statement for the current year follows:

Burien allocates building depreciation, maintenance, and utilities on the basis of square footage. Office expenses are allocated on the basis of sales.

Management is considering an expansion to a three-department operation. The proposed Department C would generate $120,000 in additional sales and have a 17.5% contribution to overhead. The company owns its building. Opening Department C would redistribute the square footage to each department as follows: A, 19,040; B, 21,760 sq. ft.; C, 13,600. Increases in indirect expenses would include: maintenance, $500; utilities, $3,800; and office expenses, $1,200.

Complete the following departmental income statements, showing projected results of operations for the three sales departments. (Round amounts to the nearest whole dollar.)

Correct Answer:

Verified

11ea8897_de0f_d4d0_a96f_55faa8...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q19: The salaries of employees who spend all

Q26: The investment center return on total assets

Q43: The China Department of the Coulsen Department

Q50: Vaughn Co.operates three separate departments (A,B,C).The

Q51: A single cost incurred in producing or

Q52: _ measures the income earned per dollar

Q53: Match the appropriate definition (a)through (h)with the

Q66: What is a cost center?

Q86: Joint costs can be allocated either using

Q97: List the steps required to prepare a