Essay

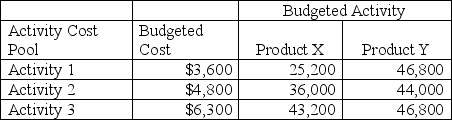

A company has two products: X and Y.It uses activity-based costing and has prepared the following analysis showing budgeted cost and activity for each of its three activity cost pools.

Annual production and sales level of Product X is 161,100 units,and the annual production and sales level of Product Y is 275,200 units.

a.Compute the approximate overhead cost per unit of Product X under activity-based costing.

b.Compute the approximate overhead cost per unit of Product Y under activity-based costing.

Correct Answer:

Verified

a.

Activity 1 allocated to Product X lin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Activity 1 allocated to Product X lin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Overhead costs:<br>A)Are directly related to production.<br>B)Can be

Q87: A _ overhead rate is a single

Q102: Reference: 17_01<br>Kudzu Company sells two products

Q103: A company's total expected overhead costs

Q108: Which types of overhead allocation methods result

Q110: Inside Out,Company designs custom showroom spaces

Q111: Aztec Industries produces bread which goes through

Q111: The following data relates to Tier

Q126: Activities causing overhead cost in an organization

Q166: The use of a plantwide overhead rate