Essay

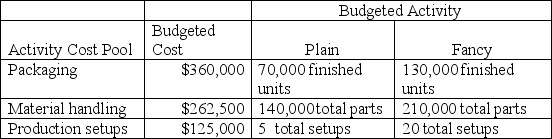

Sparks Company produces and distributes two types of garden sculptures,Plain and Fancy.Budgeted cost and activity for each of its three activity cost pools are shown below.The company plans to produce and sell 64,000 plain units and 49,150 fancy units.

a.Compute the approximate overhead cost per unit of Plain under activity-based costing.

b.Compute the approximate overhead cost per unit of Fancy under activity-based costing.

Correct Answer:

Verified

a.

Packaging allocated to plain product ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Packaging allocated to plain product ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following is not true?<br>A)

Q8: Blast Rocket Company manufactures candy-coated popcorn

Q9: A company has two products: AA and

Q10: Reference: 17_05<br>Assume that a pet food

Q45: What is the reason for pooling costs?<br>A)To

Q128: _ focuses on activities and the cost

Q134: The departmental overhead rate method uses a

Q135: Which of the following is a disadvantage

Q179: Why is overhead allocation under ABC usually

Q218: Wall Nuts, Inc. produces paneling that requires