REFERENCE: Ref.09_04 on December 1,2007,Keenan Company,a U.S.firm,sold Merchandise to Velez Company of Company

Multiple Choice

REFERENCE: Ref.09_04

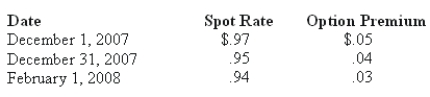

On December 1,2007,Keenan Company,a U.S.firm,sold merchandise to Velez Company of Spain for 150,000 euro.Payment is due on February 1,2008.Keenan entered into a forward exchange contract on December 1,2007,to deliver 150,000 euro on February 1,2008 for $.97.Keenan chose to use a foreign currency option to hedge this foreign currency asset designated as a cash flow hedge.Relevant exchange rates follow:

-Compute the U.S.dollars received on February 1,2008.

A) $138,000.

B) $136,500.

C) $145,500.

D) $141,000

E) $142,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: A U.S. company sells merchandise to a

Q34: A forward contract may be used for

Q46: How is the fair value of a

Q47: For each of the following situations,select the

Q48: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q50: REFERENCE: Ref.09_03<br>Car Corp.(a U.S.-based company)sold parts to

Q55: REFERENCE: Ref.09_10<br>On October 1,2007,Eagle Company forecasts the

Q60: What is meant by the spot rate?

Q67: Williams, Inc., a U.S. company, has a

Q86: Larson Company, a U.S. company, has an