REFERENCE: Ref.09_04 on December 1,2007,Keenan Company,a U.S.firm,sold Merchandise to Velez Company of Company

Multiple Choice

REFERENCE: Ref.09_04

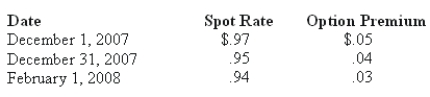

On December 1,2007,Keenan Company,a U.S.firm,sold merchandise to Velez Company of Spain for 150,000 euro.Payment is due on February 1,2008.Keenan entered into a forward exchange contract on December 1,2007,to deliver 150,000 euro on February 1,2008 for $.97.Keenan chose to use a foreign currency option to hedge this foreign currency asset designated as a cash flow hedge.Relevant exchange rates follow:

-When a U.S.company purchases parts from a foreign company,which of the following will result in no foreign exchange gain or loss?

A) The transaction is denominated in U.S.dollars.

B) The transaction resulted in an extraordinary gain.

C) The transaction resulted in an extraordinary loss.

D) The foreign currency appreciated in value relative to the U.S.dollar.

E) The foreign currency depreciated in value relative to the U.S.dollar.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A U.S. company buys merchandise from a

Q46: What amount of foreign exchange gain or

Q78: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q79: REFERENCE: Ref.09_04<br>On December 1,2007,Keenan Company,a U.S.firm,sold merchandise

Q80: On October 31,2008,Darling Company negotiated a two-year

Q83: REFERENCE: Ref.09_04<br>On December 1,2007,Keenan Company,a U.S.firm,sold merchandise

Q85: REFERENCE: Ref.09_10<br>On October 1,2007,Eagle Company forecasts the

Q86: REFERENCE: Ref.09_10<br>On October 1,2007,Eagle Company forecasts the

Q87: REFERENCE: Ref.09_08<br>On May 1,2007,Mosby Company received an

Q88: The forward rate may be defined as<br>A)