REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

Multiple Choice

REFERENCE: Ref.09_10

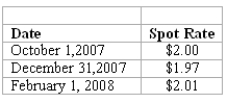

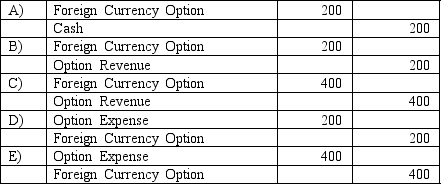

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

-What journal entry should Eagle prepare on December 31,2007?

A) A above.

B) B above.

C) C above.

D) D above.

E) E above.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: A U.S. company buys merchandise from a

Q71: REFERENCE: Ref.09_11<br>Coyote Corp.(a U.S.company in Texas)had the

Q72: REFERENCE: Ref.09_03<br>Car Corp.(a U.S.-based company)sold parts to

Q73: REFERENCE: Ref.09_02<br>Brisco Bricks purchases raw material from

Q74: Old Colonial Corp.(a U.S.company)made a sale to

Q75: REFERENCE: Ref.09_08<br>On May 1,2007,Mosby Company received an

Q78: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q79: REFERENCE: Ref.09_04<br>On December 1,2007,Keenan Company,a U.S.firm,sold merchandise

Q80: On October 31,2008,Darling Company negotiated a two-year

Q88: The forward rate may be defined as<br>A)