Multiple Choice

REFERENCE: Ref.08_10

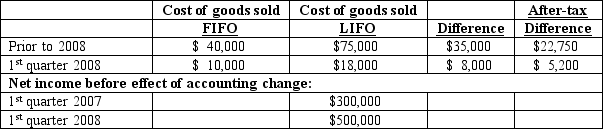

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008,how much is reported as net income for the first quarter of 2008?

A) $492,000.

B) $494,800.

C) $500,000.

D) $505,200.

E) $527,950.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: Which of the following statements is true?<br>A)

Q41: What is the appropriate treatment in an

Q42: How should a change from one generally

Q78: Kaycee Corporation's revenues for the year ended

Q79: What information does SFAS 131 require to

Q80: REFERENCE: Ref.08_14<br>Harrison Company,Inc.began operations on January 1,2008,and

Q81: Which two items of information must be

Q84: REFERENCE: Ref.08_09<br>Provo,Inc.has an estimated annual tax rate

Q86: Which of the following statements is true

Q106: Which of the following is reported for