Multiple Choice

REFERENCE: Ref.08_10

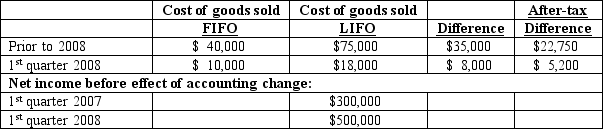

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008,compute net income per common share.

A) $4.92.

B) $4.95.

C) $5.00.

D) $5.05.

E) $5.28.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Prepare the journal entries to reflect the

Q22: SFAS 14 required a U.S.corporation to disclose

Q24: Blanton Corporation is comprised of five operating

Q25: What general information about an operating segment

Q28: REFERENCE: Ref.08_09<br>Provo,Inc.has an estimated annual tax rate

Q30: The hardware operating segment of Bloom Corporation

Q45: What is the minimum amount of revenue

Q79: Which operating segments are reportable under the

Q84: What is meant by the term: disaggregated

Q104: Which operating segments are separately reportable under