REFERENCE: Ref.06_12 On January 1,2009,Harrison Corporation Spent $2,600,000 to Acquire Control Over

Multiple Choice

REFERENCE: Ref.06_12

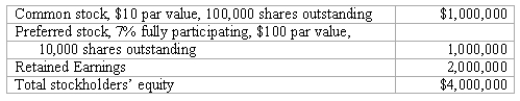

On January 1,2009,Harrison Corporation spent $2,600,000 to acquire control over Involved,Inc.This price was based on paying $750,000 for 30 percent of Involved's preferred stock,and $1,850,000 for 80 percent of its outstanding common stock.As of the date of the acquisition,Involved's stockholders' equity accounts were as follows:

-Johnson,Inc.owns control over Kaspar,Inc.Johnson reports sales of $400,000 during 2009 while Kaspar reports $250,000.Kaspar transferred inventory during 2009 to Johnson at a price of $50,000.On December 31,2009,30 percent of the transferred goods are still in Johnson's inventory.Consolidated accounts receivable on January 1,2009 was $120,000,and on December 31,2009 is $130,000.Johnson uses the direct approach in preparing the statement of cash flows.How much is cash collected from customers on the consolidated statement of cash flows?

A) $590,000.

B) $610,000.

C) $625,000.

D) $635,000.

E) $650,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Compute the goodwill recognized in consolidation.<br>A) $

Q44: Webb Company owns 90% of Jones

Q65: REFERENCE: Ref.06_10<br>Anderson,Inc.has owned 70% of its subsidiary,Arthur

Q66: REFERENCE: Ref.06_02<br>Stoop Co.owned 80% of the common

Q69: Parent Corporation acquired some of its subsidiary's

Q70: REFERENCE: Ref.06_14<br>Thomas Inc.had the following stockholders' equity

Q71: REFERENCE: Ref.06_01<br>On January 1,2009,Riney Co.owned 85% of

Q72: A special purpose entity can take all

Q95: Which of the following statements is true

Q108: In reporting consolidated earnings per share when