Essay

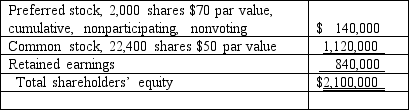

On January 1,2009,Bast Co.had a net book value of $2,100,000 as follows:

Fisher Co.acquired all of the outstanding preferred shares for $148,000 and 60% of the common stock for $1,281,000.Fisher believed that one of Bast's buildings,with a twelve-year life,was undervalued on the company's financial records by $70,000.

Required:

What is the amount of goodwill to be recognized from this purchase?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Parent Corporation loaned money to its subsidiary

Q3: What would differ between a statement of

Q4: REFERENCE: Ref.06_10<br>Anderson,Inc.has owned 70% of its subsidiary,Arthur

Q6: REFERENCE: Ref.06_14<br>Thomas Inc.had the following stockholders' equity

Q9: REFERENCE: Ref.06_03<br>These questions are based on the

Q11: What is the total acquisition-date fair value

Q24: Which of the following statements is true

Q32: On January 1, 2009, Nichols Company

Q93: Where does the noncontrolling interest in Stage's

Q105: What should the adjusted book value of