Essay

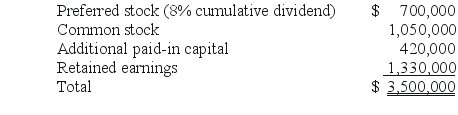

Skipen Corp.had the following stockholders' equity accounts:

SHAPE \* MERGEFORMAT

The preferred stock was participating and is therefore considered to be equity.Vestin Corp.acquired 90% of this common stock for $2,250,000 and 70% of the preferred stock for $1,120,000.All of the subsidiary's assets and liabilities were determined to have fair values equal to their book values except for land which is undervalued by $130,000.

Required:

What amount was attributed to goodwill on the date of acquisition?

Correct Answer:

Verified

Correct Answer:

Verified

Q14: What is the amount of goodwill resulting

Q44: Describe how this transaction would affect Panton's

Q44: Describe how this transaction would affect Panton's

Q49: A parent acquires 70% of a subsidiary's

Q78: Ryan Company owns 80% of Chase

Q83: Webb Company owns 90% of Jones

Q94: REFERENCE: Ref.06_02<br>Stoop Co.owned 80% of the common

Q95: The accounting problems encountered in consolidated intercompany

Q97: Where do intercompany sales of inventory appear

Q99: REFERENCE: Ref.06_02<br>Stoop Co.owned 80% of the common