REFERENCE: Ref.05_02 On January 1,2009,Pride,Inc.bought 80% of the Outstanding Voting Common Stock

Multiple Choice

REFERENCE: Ref.05_02

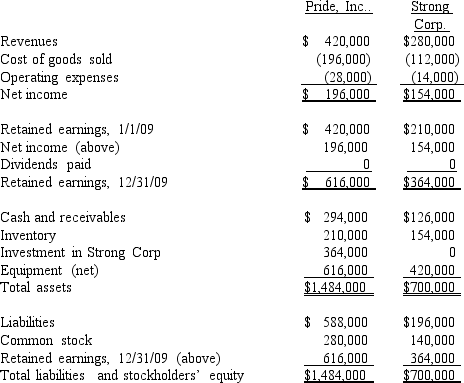

On January 1,2009,Pride,Inc.bought 80% of the outstanding voting common stock of Strong Corp.for $364,000.Of this payment,$28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000.Any remaining excess was attributable to goodwill which has not been impaired.

As of December 31,2009,before preparing the consolidated worksheet,the financial statements appeared as follows:

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

-What is the consolidated total for equipment (net) at December 31,2009?

A) $952,000.

B) $1,058,400.

C) $1,069,600.

D) $1,064,000.

E) $1,066,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: What is the total of consolidated cost

Q73: REFERENCE: Ref.05_10<br>Stark Company,a 90% owned subsidiary of

Q74: REFERENCE: Ref.05_05<br>Gargiulo Company,a 90% owned subsidiary of

Q75: REFERENCE: Ref.05_09<br>Stiller Company,an 80% owned subsidiary of

Q76: How is the gain on an intercompany

Q77: REFERENCE: Ref.05_04<br>Walsh Company sells inventory to its

Q79: Why do intercompany transfers between the component

Q80: Dithers Inc.acquired all of the common stock

Q81: REFERENCE: Ref.05_09<br>Stiller Company,an 80% owned subsidiary of

Q82: Which of the following statements is true