Multiple Choice

REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90% owned subsidiary of Simon Company,bought equipment from Simon for $68,250.On January 1,2009,Simon realized that the useful life of the equipment was longer than originally anticipated,at ten remaining years.The equipment had an original cost to Simon of $80,000 and a book value of $50,000 with a 10-year remaining life as of January 1,2009.

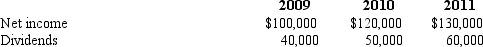

The following data are available pertaining to Wilson's income and dividends:

-Compute the amortization of gain for 2009 for consolidation purposes.

A) $1,950.

B) $1,825.

C) $1,500.

D) $2,000.

E) $5,250.

Correct Answer:

Verified

Correct Answer:

Verified

Q99: An intercompany sale took place whereby the

Q100: Tara Company holds 80 percent of the

Q101: How do upstream and downstream inventory transfers

Q103: REFERENCE: Ref.05_03<br>Strickland Company sells inventory to its

Q105: Gibson Corp.owned a 90% interest in Sparis

Q106: Norek Corp.owned 70% of the voting common

Q107: REFERENCE: Ref.05_01<br>Pot Co.holds 90% of the common

Q108: REFERENCE: Ref.05_08<br>On January 1,2009,Smeder Company,an 80% owned

Q109: REFERENCE: Ref.05_01<br>Pot Co.holds 90% of the common

Q112: What is the total of consolidated revenues?<br>A)