Multiple Choice

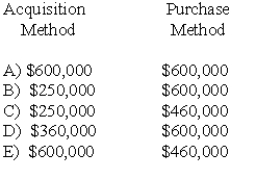

MacHeath Inc.bought 60% of the outstanding common stock of Nomes Inc.in a business combination that resulted in the recognition of goodwill.Nomes owned a piece of land that cost $250,000 but was worth $600,000 at the date of purchase.What value would be attributed to this land in a consolidated balance sheet at the date of takeover,according to the acquisition method per SFAS 141(R) and the purchase method per SFAS 141?

A) Entry A

B) Entry B

C) Entry C

D) Entry D

E) Entry E

Correct Answer:

Verified

Correct Answer:

Verified

Q41: Which of the following statements is false

Q42: When a parent uses the partial equity

Q43: In consolidation at January 1,2009,what adjustment is

Q44: What is the dollar amount of non-controlling

Q45: What is consolidated current liabilities as of

Q46: The non-controlling interest's share shown on Denber's

Q47: In consolidation at December 31,2010,what net adjustment

Q48: Under the acquisition method of accounting for

Q49: According to SFAS 160,Non-controlling Interests and Consolidated

Q51: What is consolidated noncurrent assets as of