Multiple Choice

REFERENCE: Ref.03_04

Jans Inc.acquired all of the outstanding common stock of Tysk Corp.on January 1,2009,for $372,000.Equipment with a ten-year life was undervalued on Tysk's financial records by $46,000.Tysk also owned an unrecorded customer list with an assessed fair value of $67,000 and an estimated remaining life of five years.

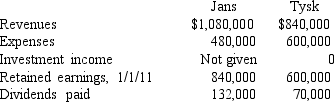

Tysk earned reported net income of $180,000 in 2009 and $216,000 in 2010.Dividends of $70,000 were paid in each of these two years.Selected account balances as of December 31,20011,for the two companies follow.

-If the equity method had been applied,what would be the Investment in Tysk Corp.account balance within the records of Jans at the end of 20011?

A) $612,100.

B) $744,000.

C) $774,150.

D) $372,000.

E) $844,150.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Red Co.acquired 100% of Green,Inc.on October 1,2009.On

Q28: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q29: REFERENCE: Ref.03_03<br>Cashen Co.paid $2,400,000 to acquire all

Q31: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q34: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q36: In accounting for an acquisition using the

Q37: REFERENCE: Ref.03_09<br>Harrison,Inc.acquires 100% of the voting stock

Q38: Under the initial value method, when accounting

Q61: Kaye Company acquired 100% of Fiore Company

Q113: Why is push-down accounting a popular internal