Multiple Choice

REFERENCE: Ref.03_07

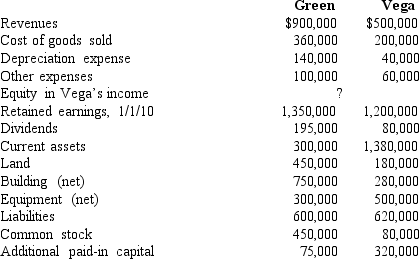

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated land.

A) $220,000.

B) $180,000.

C) $670,000.

D) $630,000.

E) $450,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Which of Pritchett's reporting units require both

Q68: Prince Company acquires Duchess, Inc. on January

Q97: When is a goodwill impairment loss recognized?<br>A)

Q100: Under the partial equity method of accounting

Q101: REFERENCE: Ref.03_07<br>Following are selected accounts for Green

Q102: REFERENCE: Ref.03_07<br>Following are selected accounts for Green

Q103: REFERENCE: Ref.03_01<br>On January 1,2009,Cale Corp.paid $1,020,000 to

Q105: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q107: REFERENCE: Ref.03_06<br>Kaye Company acquired 100% of Fiore

Q110: Kaye Company acquired 100% of Fiore Company