REFERENCE: Ref.03_12 Watkins,Inc.acquires All of the Outstanding Stock of Glen Corporation on Corporation

Multiple Choice

REFERENCE: Ref.03_12

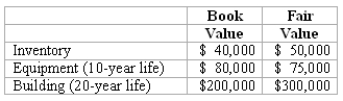

Watkins,Inc.acquires all of the outstanding stock of Glen Corporation on January 1,2009.At that date,Glen owns only three assets and has no liabilities:

-If Watkins pays $450,000 in cash for Glen,what amount would be represented as the subsidiary's Building in a consolidation at December 31,2011,assuming the book value at that date is still $200,000?

A) $200,000.

B) $285,000.

C) $290,000.

D) $295,000.

E) $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q52: Jansen Inc.acquired all of the outstanding common

Q53: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q54: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q55: Velway Corp.acquired Joker Inc.on January 1,2009.The parent

Q58: Consolidated net income using the equity method

Q59: REFERENCE: Ref.03_11<br>Prince Company acquires Duchess,Inc.on January 1,2009.The

Q60: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q62: REFERENCE: Ref.03_01<br>On January 1,2009,Cale Corp.paid $1,020,000 to

Q67: Figure:<br>On 4/1/09, Sey Mold Corporation acquired 100%

Q83: What is the partial equity method? How