REFERENCE: Ref.03_12 Watkins,Inc.acquires All of the Outstanding Stock of Glen Corporation on Corporation

Multiple Choice

REFERENCE: Ref.03_12

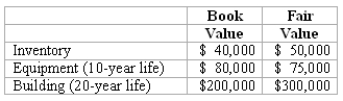

Watkins,Inc.acquires all of the outstanding stock of Glen Corporation on January 1,2009.At that date,Glen owns only three assets and has no liabilities:

-If Watkins pays $300,000 in cash for Glen,at what amount would the subsidiary's Building be represented in a January 2,2009 consolidation?

A) $200,000.

B) $225,000.

C) $273,000.

D) $279,000.

E) $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: REFERENCE: Ref.03_01<br>On January 1,2009,Cale Corp.paid $1,020,000 to

Q40: REFERENCE: Ref.03_09<br>Harrison,Inc.acquires 100% of the voting stock

Q41: REFERENCE: Ref.03_13<br>Fesler Inc.acquired all of the outstanding

Q42: REFERENCE: Ref.03_10<br>Beatty,Inc.acquires 100% of the voting stock

Q43: REFERENCE: Ref.03_13<br>Fesler Inc.acquired all of the outstanding

Q47: REFERENCE: Ref.03_08<br>Goehler,Inc.acquires all of the voting stock

Q48: Carnes Co.decided to use the partial equity

Q49: REFERENCE: Ref.03_07<br>Following are selected accounts for Green

Q63: How much difference would there have been

Q84: Under the equity method of accounting for