Essay

REFERENCE: Ref.03_15

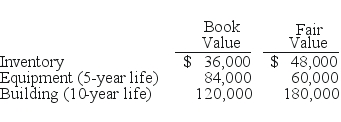

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

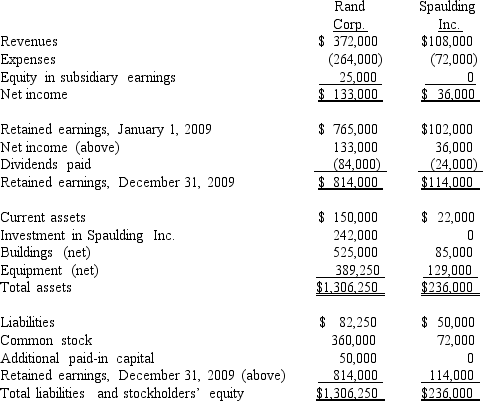

-On January 1,2009,Rand Corp.issued shares of its common stock for all of the outstanding common stock of Spaulding Inc.This combination was accounted for as a purchase.Spaulding's book value was only $140,000 at the time,but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share.Rand was willing to convey these shares because it felt that buildings (ten-year life)were undervalued on Spaulding's records by $60,000 while equipment (five-year life)was undervalued by $25,000.Any excess cost over fair value is assigned to goodwill.

Following are the individual financial records for these two companies for the year ended December 31,2009.

Required:

Prepare a consolidation worksheet for this business combination.

Correct Answer:

Verified

Consolidation Worksheet for Ra...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: For an acquisition when the subsidiary maintains

Q73: Which of the following will result in

Q75: REFERENCE: Ref.03_07<br>Following are selected accounts for Green

Q76: When consolidating a subsidiary under the equity

Q77: How does the partial equity method differ

Q78: What accounting method requires a subsidiary to

Q79: REFERENCE: Ref.03_07<br>Following are selected accounts for Green

Q81: When a company applies the partial equity

Q84: For each of the following situations,select the

Q85: According to SFAS 142,which of the following