REFERENCE: Ref.02_02 Prior to Being United in a Business Combination,Botkins Inc.and Volkerson

Multiple Choice

REFERENCE: Ref.02_02

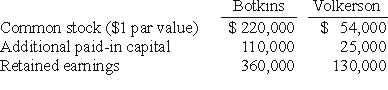

Prior to being united in a business combination,Botkins Inc.and Volkerson Corp.had the following stockholders' equity figures:  Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

-Assume that Botkins acquired Volkerson as a purchase combination.Immediately afterwards,what are consolidated Additional Paid-In Capital and Retained Earnings,respectively?

A) $133,000 and $360,000.

B) $236,000 and $360,000.

C) $130,000 and $360,000.

D) $236,000 and $490,000.

E) $133,000 and $490,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Figure:<br>The financial statements for Goodwin, Inc., and

Q69: Figure:<br>Flynn acquires 100 percent of the outstanding

Q71: Fine Co.issued its common stock in exchange

Q72: In a transaction accounted for using the

Q74: REFERENCE: Ref.02_07<br>Presented below are the financial balances

Q75: REFERENCE: Ref.02_03<br>The financial statements for Goodwin,Inc. ,and

Q77: REFERENCE: Ref.02_07<br>Presented below are the financial balances

Q78: Which one of the following is a

Q80: The following are preliminary financial statements for

Q81: REFERENCE: Ref.02_06<br>The financial balances for the Atwood