REFERENCE: Ref.02_02 Prior to Being United in a Business Combination,Botkins Inc.and Volkerson

Multiple Choice

REFERENCE: Ref.02_02

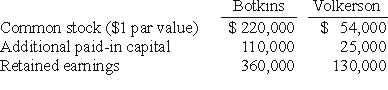

Prior to being united in a business combination,Botkins Inc.and Volkerson Corp.had the following stockholders' equity figures:  Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

Botkins issued 56,000 new shares of its common stock valued at $3.25 per share for all of the outstanding stock of Volkerson.

-Assume that Botkins and Volkerson were being joined in a pooling of interests and this occurred on January 1,2000,using the same values given .Immediately afterwards,what is consolidated Additional Paid-In Capital?

A) $138,000.

B) $266,000.

C) $130,000.

D) $236,000.

E) $133,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Prepare the journal entries to record: (1)

Q35: Figure:<br>The financial statements for Goodwin, Inc., and

Q89: What is the difference in consolidated results

Q104: REFERENCE: Ref.02_08<br>Flynn acquires 100 percent of the

Q105: Which of the following statements is true

Q106: Assume that Bellington paid cash of $2.8

Q107: REFERENCE: Ref.02_07<br>Presented below are the financial balances

Q109: Direct combination costs and stock issuance costs

Q111: Bale Co.acquired Silo Inc.on October 1,20X1,in a

Q112: REFERENCE: Ref.02_03<br>The financial statements for Goodwin,Inc. ,and