Multiple Choice

REFERENCE: Ref.02_06

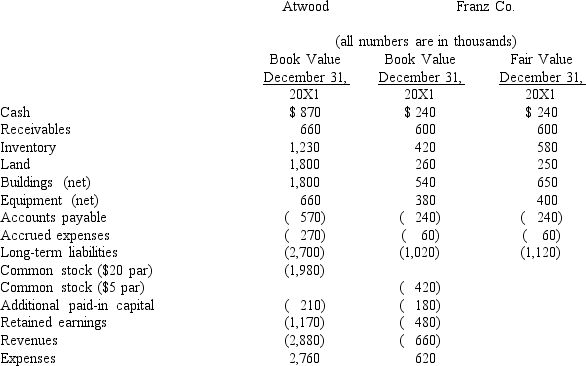

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Assuming Atwood accounts for the combination as a purchase,compute consolidated goodwill at the date of the combination.

A) $360.

B) $450.

C) $460.

D) $440.

E) $475.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Prepare the journal entries to record: (1)

Q14: Figure:<br>Presented below are the financial balances for

Q35: Figure:<br>The financial statements for Goodwin, Inc., and

Q68: Figure:<br>Flynn acquires 100 percent of the outstanding

Q111: Bale Co.acquired Silo Inc.on October 1,20X1,in a

Q112: REFERENCE: Ref.02_03<br>The financial statements for Goodwin,Inc. ,and

Q114: How are stock issuance costs and direct

Q117: In a purchase or acquisition where control

Q118: REFERENCE: Ref.02_06<br>The financial balances for the Atwood

Q119: REFERENCE: Ref.02_08<br>Flynn acquires 100 percent of the