Multiple Choice

REFERENCE: Ref.02_06

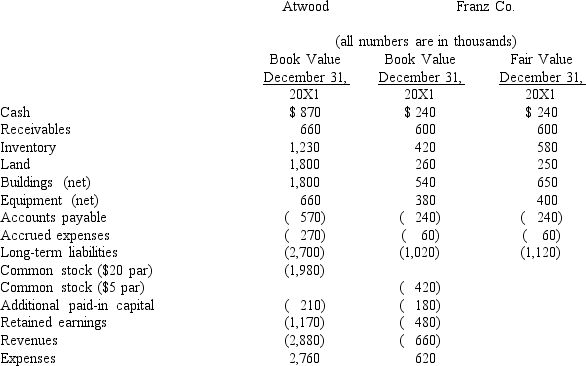

The financial balances for the Atwood Company and the Franz Company as of December 31,20X1,are presented below.Also included are the fair values for Franz Company's net assets.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,20X1.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

-Assuming Atwood accounts for the combination as an acquisition,compute consolidated goodwill at the date of the combination.

A) $360.

B) $450.

C) $460.

D) $440.

E) $475.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Figure:<br>Flynn acquires 100 percent of the outstanding

Q51: REFERENCE: Ref.02_01<br>Bullen Inc.assumed 100% control over Vicker

Q52: According to SFAS No.141,the pooling of interest

Q53: A company is not required to consolidate

Q54: How are direct combination costs accounted for

Q55: REFERENCE: Ref.02_01<br>Bullen Inc.assumed 100% control over Vicker

Q57: How is contingent consideration accounted for according

Q59: REFERENCE: Ref.02_01<br>Bullen Inc.assumed 100% control over Vicker

Q60: For purchase accounting,why are assets and liabilities

Q61: Describe the accounting for direct costs,indirect costs,and