Multiple Choice

REFERENCE: Ref.02_08

Flynn acquires 100 percent of the outstanding voting shares of Macek Company on January 1,20X1.To obtain these shares,Flynn pays $400 (in thousands) and issues 10,000 shares of $20 par value common stock on this date.Flynn's stock had a fair value of $36 per share on that date.Flynn also pays $15 (in thousands) to a local investment firm for arranging the transaction.An additional $10 (in thousands) was paid by Flynn in stock issuance costs.

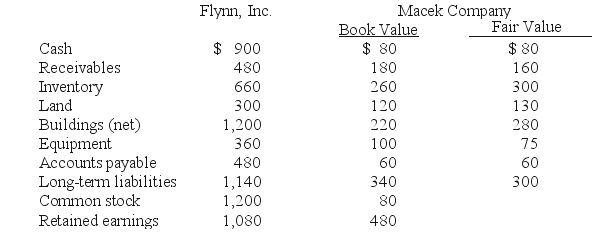

The book values for both Flynn and Macek as of January 1,20X1 follow.The fair value of each of Flynn and Macek accounts is also included.In addition,Macek holds a fully amortized trademark that still retains a $40 (in thousands) value.The figures below are in thousands.Any related question also is in thousands.

SHAPE \* MERGEFORMAT

-Assuming the combination is accounted for as an acquisition,what amount will be reported for consolidated retained earnings?

A) $1,065.

B) $1,080.

C) $1,525.

D) $1,535.

E) $1,560.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Dutch Co. has loaned $90,000 to its

Q8: A statutory merger is a(n)<br>A) business combination

Q11: REFERENCE: Ref.02_06<br>The financial balances for the Atwood

Q12: How are bargain purchases different between SFAS

Q18: REFERENCE: Ref.02_06<br>The financial balances for the Atwood

Q20: Determine consolidated Paid-in Capital at December 31,2009.

Q65: Figure:<br>Presented below are the financial balances for

Q94: Figure:<br>The financial statements for Goodwin, Inc., and

Q97: Figure:<br>Presented below are the financial balances for

Q106: Elon Corp. obtained all of the common