Essay

REFERENCE: Ref.02_10

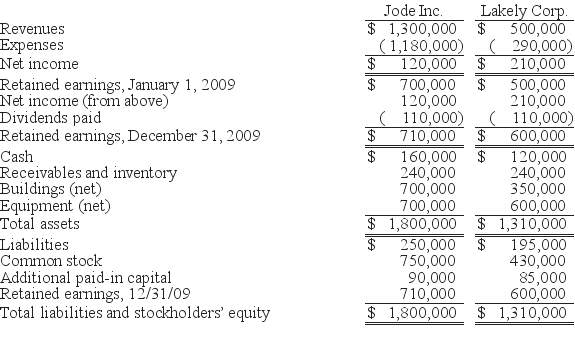

The financial statements for Jode Inc.and Lakely Corp. ,just prior to their combination,for the year ending December 31,2009,follow.Lakely's buildings were undervalued on its financial records by $60,000.

SHAPE \* MERGEFORMAT

On December 31,2009,Jode issued 54,000 new shares of its $10 par value stock to the owners of Lakely in exchange for all of the outstanding shares of that company.Jode's shares had a fair value on that date of $35 per share.Jode paid $34,000 to an investment bank for assisting in the arrangements.Jode also paid $24,000 in stock issuance costs.This combination is accounted for as an acquisition.

On December 31,2009,Jode issued 54,000 new shares of its $10 par value stock to the owners of Lakely in exchange for all of the outstanding shares of that company.Jode's shares had a fair value on that date of $35 per share.Jode paid $34,000 to an investment bank for assisting in the arrangements.Jode also paid $24,000 in stock issuance costs.This combination is accounted for as an acquisition.

-Required:

Determine consolidated Net Income for at December 31,2009.

Correct Answer:

Verified

SHAPE \* M...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: REFERENCE: Ref.02_07<br>Presented below are the financial balances

Q46: REFERENCE: Ref.02_06<br>The financial balances for the Atwood

Q47: Chapel Hill Company had common stock of

Q48: Elon Corp.purchased all of the common stock

Q51: REFERENCE: Ref.02_01<br>Bullen Inc.assumed 100% control over Vicker

Q52: According to SFAS No.141,the pooling of interest

Q53: A company is not required to consolidate

Q54: How are direct combination costs accounted for

Q55: REFERENCE: Ref.02_01<br>Bullen Inc.assumed 100% control over Vicker

Q102: Lisa Co. paid cash for all of