Multiple Choice

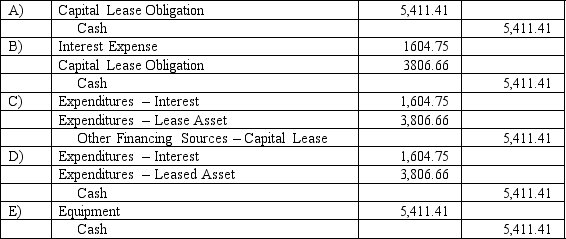

A five-year lease is signed by the City of Wachovia for equipment with a seven-year life.The asset will be returned to the lessor at the end of the lease.The present value of the lease is $20,000,and annual payments of $5,411.41 are payable beginning on the date the lease is signed.The interest portion of the second payment is $1,604.75.The equipment is to be used in City Hall and was purchased from appropriated funds of the General Fund.

What entry should be made for the government-wide financial statements one year from the date the lease is signed?

A) Entry A.

B) Entry B.

C) Entry C.

D) Entry D.

E) Entry E.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: What is meant by the term fiscally

Q9: Which criteria must be met to be

Q13: The parking garage and parking lots owned

Q14: Which statement is false regarding the Statement

Q15: The employees of the City of Raymond

Q19: Which of the following is a financial

Q30: Which of the following is not a

Q35: The Town of Portsmouth has at the

Q41: Which one of the following is a

Q42: Which of the following is a section