Essay

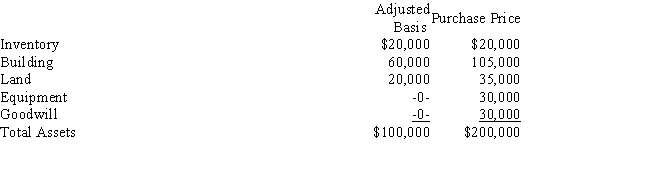

Dorothy operates a pet store as a sole proprietorship. During the year, she sells the business to Florian for $200,000. The assets sold and the allocation of the purchase price are as follows:

Dorothy acquired the building in 1997 for $100,000 of which $20,000 was allocated to the land. She paid $40,000 for the equipment in the same year. What are the tax consequences of the liquidation for Dorothy?

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A family entity combines the tax-planning aspects

Q3: If a sole proprietorship has a net

Q4: Peter owns 30% of Bear Company, an

Q5: A corporation's excess charitable contributions over the

Q6: A corporation may reduce trade or business

Q7: William, a CPA, owns a 75% interest

Q8: Henritta is the sole shareholder of Quaker

Q9: Sandi and Jodie are partners who

Q10: Toliver Corporation incurs a long-term capital loss

Q11: Match the term with the entity to