Multiple Choice

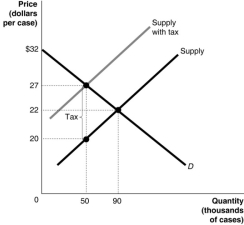

Figure 5.7  Figure 5.7 shows the market for beer.The government plans to impose a unit tax in this market.

Figure 5.7 shows the market for beer.The government plans to impose a unit tax in this market.

-Refer to Figure 5.7.As a result of the tax, is there a loss in consumer surplus?

A) Yes, because consumers are paying a price above the economically efficient price.

B) No, because the producer pays the tax.

C) No, because the market reaches a new equilibrium.

D) No, because consumers are charged a lower price to cover their tax burden.

Correct Answer:

Verified

Correct Answer:

Verified

Q25: Figure 5.4 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 5.4

Q27: Figure 5.5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 5.5

Q32: Economic efficiency is defined as a market

Q33: Figure 5.3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 5.3

Q35: Figure 5.1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 5.1

Q54: The excess burden of a tax is

Q60: Suppose an excise tax of $1 is

Q86: In the economic sense, almost everything is

Q129: The following equations represent the demand and

Q134: Producer surplus is the difference between the