Multiple Choice

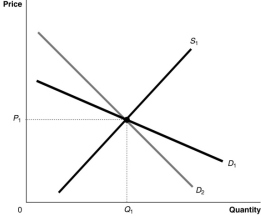

Figure 5.9

-Refer to Figure 5.9.Suppose the market is initially in equilibrium at price P1, and then the government imposes a tax on every unit sold.Which of the following statements best describes the impact of the tax?

A) The consumer will bear a smaller share of the tax burden if the demand curve is D1.

B) The consumer's share of the tax burden is the same whether the demand curve is D1 or D2.

C) The consumer will bear a smaller share of the tax burden if the demand curve is D2.

D) The consumer will bear the entire burden of the tax if the demand curve is D2, and the producer will bear the entire burden of the tax if the demand curve is D1.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Assume the market price for lemon grass

Q17: Figure 5.4 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 5.4

Q18: Table 5.2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Table 5.2

Q19: Figure 5.5 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 5.5

Q24: Figure 5.1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 5.1

Q25: Figure 5.4 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 5.4

Q57: Rent control is an example of a

Q96: The total amount of producer surplus in

Q103: A price ceiling is a legally determined

Q120: The total amount of consumer surplus in