Essay

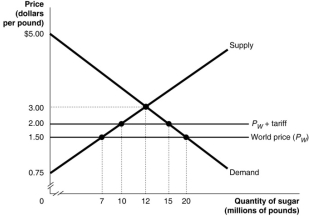

Figure 13.1  Suppose the government imposes a $0.50 per metric tariff on sugar imports.Figure 13-1 shows the demand and supply curves for sugar and the impact of this tariff.

Suppose the government imposes a $0.50 per metric tariff on sugar imports.Figure 13-1 shows the demand and supply curves for sugar and the impact of this tariff.

-Use Figure 13.1 to answer questions a-i.

a.Following the imposition of the tariff, what is the price that domestic consumers must now pay and what is the quantity purchased?

b.Calculate the value of consumer surplus with the tariff in place.

c.What is the quantity supplied by domestic sugar producers with the tariff in place?

d.Calculate the value of producer surplus received by Australian sugar producers with the tariff in place.

e.What is the quantity of sugar imported with the tariff in place?

f.What is the amount of tariff revenue collected by the government?

g.The tariff has reduced consumer surplus.Calculate the loss in consumer surplus due to the tariff.

h.What portion of the consumer surplus loss is redistributed to domestic producers? To the government?

i.Calculate the deadweight loss due to the tariff.

Correct Answer:

Verified

a.Price = $2.00 per metric; Quantity pur...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Imposing tariffs in cases of dumping<br>A)is allowed

Q84: Table 13.6<br>Production and<br>Consumption Production<br>Without Trade With Trade

Q86: Between 1960 and 2010, Australia's imports increased

Q87: In the real world we don't observe

Q88: Table 13.3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Table 13.3

Q90: Table 13.6<br>Production and<br>Consumption Production<br>Without Trade With Trade

Q91: _ is the ability of an individual,

Q92: What is offshoring?<br>A)When workers in a foreign

Q132: The selling of a product for a

Q188: A tariff is a tax imposed by