Essay

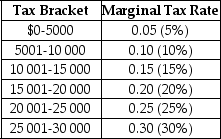

Last year,Anthony Millanti earned exactly $30 000 of taxable income.Assume that the income tax system used to determine Anthony's tax liability is progressive.The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a.Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket,and the total tax he owes the government.(Assume that there are no allowable tax deductions,tax credits,personal exemptions or any other deductions that Anthony can use to reduce his tax liability).

b.Determine Anthony's average tax rate.

Correct Answer:

Verified

a.

b.The average tax rate i...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.The average tax rate i...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: When considering changes in tax policy, economists

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4183/.jpg" alt=" -Refer to Figure

Q25: Suppose the government imposes an 8 percent

Q31: Figure 16.6 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 16.6

Q41: If you pay $14 000 in taxes

Q55: Describe the main factors economists believe cause

Q148: Consider a public good such as fire

Q215: The federal corporate income tax is<br>A)regressive.<br>B)proportional.<br>C)progressive.<br>D)unfair.

Q235: If you pay $2,000 in taxes on

Q251: A regressive tax is a tax for