Multiple Choice

Figure 16.1

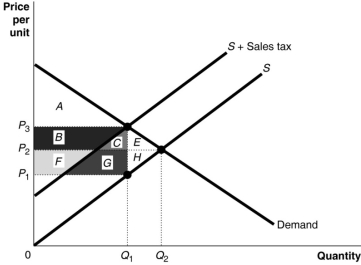

-Refer to Figure 16.1.Area B + C + F + G represents

A) the portion of sales tax revenue borne by consumers.

B) the portion of sales tax revenue borne by producers.

C) the excess burden of the sales tax.

D) sales tax revenue collected by the government.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: How are exemptions and deductions used?<br>A)By taxpayers

Q12: Figure 16.6 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 16.6

Q13: Figure 16.1 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 16.1

Q18: Figure 16.2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 16.2

Q73: The actual division of the burden of

Q133: What is meant by "tax incidence"?

Q140: Horizontal equity is achieved when taxes are

Q156: The idea that two taxpayers in the

Q212: If grocery stores were legally required to

Q222: If you pay $3,000 in taxes on