Multiple Choice

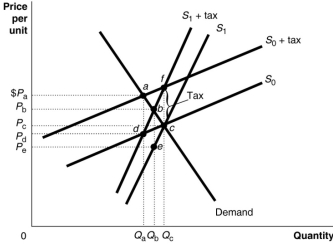

Figure 16.2  Figure 16.2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

Figure 16.2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 16.2.If the government imposes an excise tax of $1.00 on every unit sold, the consumer's burden of the tax

A) is Pa - Pc under either supply curve.

B) is Pb - Pc under either supply curve.

C) is Pa - Pc if the supply curve is S0 and Pb - Pc if the supply curve is S1.

D) is Pa - Pd if the supply curve is S0 and Pb - Pe if the supply curve is S1.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Income inequality increases as the Gini coefficient

Q6: There is a difference between who is

Q8: If the government is most interested in

Q9: Figure 16.2 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1015/.jpg" alt="Figure 16.2

Q10: How are exemptions and deductions used?<br>A)By taxpayers

Q60: If the marginal tax rate is equal

Q73: The actual division of the burden of

Q98: If the marginal tax rate is greater

Q145: The excess burden of a tax<br>A)measures the

Q229: The term "payroll taxes" is often used