Multiple Choice

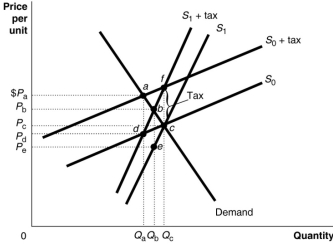

Figure 16.2  Figure 16.2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

Figure 16.2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 16.2.If the government imposes an excise tax of $1.00 on every unit sold, the consumer's burden of the tax

A) is greater under the more elastic supply curve S0.

B) is greater under the less elastic supply curve S0.

C) is greater under the less elastic supply curve S1.

D) is the same under either supply curve because there is a single demand curve that captures buyers' market behaviour.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Most economists agree that some of the

Q14: When considering changes in tax policy, economists

Q25: Suppose the government imposes an 8 percent

Q36: If you pay $3000 in taxes on

Q37: Which formula below would a taxpayer use

Q38: If the government wants to minimise the

Q39: What is a statistical tool used to

Q46: 'Sin taxes,' such as taxes on alcoholic

Q230: A marginal tax rate is<br>A)the fraction of

Q238: According to the horizontal-equity principle of taxation,<br>A)individuals