Multiple Choice

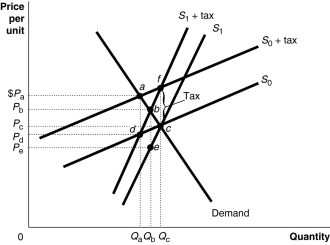

-Refer to Figure 16-2. If the government imposes an excise tax of $1.00 on every unit sold, what is the size of the deadweight loss, if there is any?

A) the area adc if the supply curve is S0 and the area bec if the supply curve is S1

B) the area afcd if the supply curve is S0 and the area bfce if the supply curve is S1

C) the area becf under either supply curve

D) There is no deadweight loss; revenue raised is used to fund government projects.

Correct Answer:

Verified

Correct Answer:

Verified

Q44: A Gini coefficient of _ means that

Q47: As the value of the Gini coefficient

Q82: The federal government and some state governments

Q93: Economists argue that the corporate income tax

Q95: For a given supply curve, how does

Q108: An income tax system is _ if

Q111: Horizontal equity means that two people in

Q113: The corporate income tax is ultimately paid

Q128: If you pay $2,000 in taxes on

Q191: What is the difference between the poverty