Essay

Use the design shown in Figure 8.1 to construct a complete repayment schedule including the totaling of the Amount Paid, Interest Paid, and Principal Repaid columns for the following loan.

On April 22, Tim borrowed $2900.00 from Keewatin Credit Union at 6.5% per annum calculated on the daily balance. He gave the Credit Union four cheques for $535.00 dated the 15th of each of the next four months starting May 15 and a cheque dated October 15 for the remaining balance to cover payment of interest and repayment of principal.

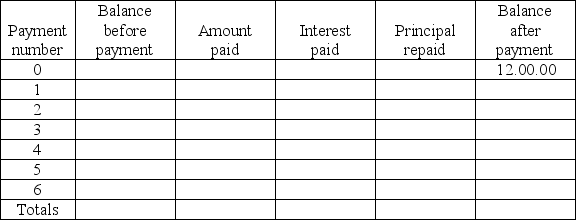

-You borrowed the amount indicated in the Balance after payment column of the following schedule from your friendly credit union. You agreed to repay the loan in monthly payments equal to  of the original loan, including interest due and principal. Interest is charged at a rate of 12.2% per annum computed on the monthly balance.

of the original loan, including interest due and principal. Interest is charged at a rate of 12.2% per annum computed on the monthly balance.

Repayment Schedule

Required: Complete the repayment schedule (this includes totaling of the Payment, Interest paid and Principal repaid columns to check the accuracy of your work).

Required: Complete the repayment schedule (this includes totaling of the Payment, Interest paid and Principal repaid columns to check the accuracy of your work).

a) What is the loan balance after the third payment?

b) What is the total amount needed to repay the loan?

Correct Answer:

Verified

Repayment ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: What is the face value of a

Q21: A $2850, five-month promissory note with interest

Q21: For the following promissory note, determine the

Q26: Compute the present value of a 150-day

Q30: Find the proceeds of a six-month note

Q65: A 7-month note dated May 1, 2014

Q66: You purchase a 182-day treasury bill for

Q68: Find the maturity value of a 60-day,

Q79: Find the maturity date and the maturity

Q84: Find the maturity value of a six-month,