Essay

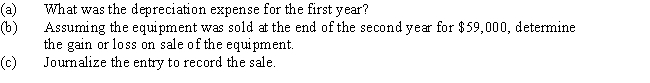

Equipment was acquired at the beginning of the year at a cost of $75,000.The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,500.

Correct Answer:

Verified

(a)$11,250 [(Cost - Residual Value) / Us...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Intangible assets differ from property, plant, and

Q40: Revising depreciation estimates affects the amounts of

Q54: Which of the following is included in

Q86: The Weber Company purchased a mining site

Q92: A machine costing $185,000 with a 5-year

Q98: Equipment with a cost of $220,000 has

Q108: Sands Company purchased mining rights for $500,000.

Q116: A machine with a cost of $120,000

Q153: Minerals removed from the earth are classified

Q225: Which of the following should be included