Essay

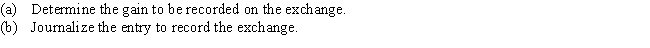

On the first day of the fiscal year,a new walk-in cooler with a list price of $58,000 was acquired in exchange for an old cooler and $44,000 cash.The old cooler had a cost of $25,000 and accumulated depreciation of $16,000.

Assume the transaction has commercial substance.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Land acquired as a speculation is reported

Q14: Convert each of the following estimates of

Q49: Losses on the discarding of fixed assets

Q79: When selling a piece of equipment for

Q107: The accumulated depletion account is<br>A) an expense

Q146: Patents are exclusive rights to produce and

Q150: Computer equipment was acquired at the beginning

Q175: Which of the following are criteria for

Q180: Though a piece of equipment is still

Q202: When a property, plant, and equipment asset