Essay

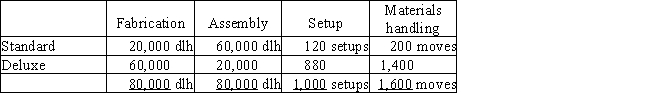

The Canine Company has total estimated factory overhead for the year of $2,400,000,divided into four activities: fabrication,$1,200,000; assembly,$480,000; setup,$400,000; and materials handling,$320,000.Canine manufactures two products,Standard Crates and Deluxe Crates.The activity-base usage quantities for each product by each activity are as follows:

Each product is budgeted for 20,000 units of production for the year.

Each product is budgeted for 20,000 units of production for the year.

Determine (a)the activity rates for each activity and (b)the factory overhead cost per unit for each product using activity-based costing.

Correct Answer:

Verified

(a)Fabrication: $1,200,000 / 80,000 = $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Differential revenue is the amount of increase

Q32: The total cost concept includes all manufacturing

Q52: Match each definition that follows with the

Q115: What is the contribution margin per machine

Q141: What is the differential revenue of producing

Q155: The Porter Beverage Factory owns a building

Q158: Keating Co.is considering disposing of equipment that

Q160: Jay Company uses the total cost concept

Q161: Determine the markup percentage on product cost.<br>A)

Q165: A cost that will not be affected