Multiple Choice

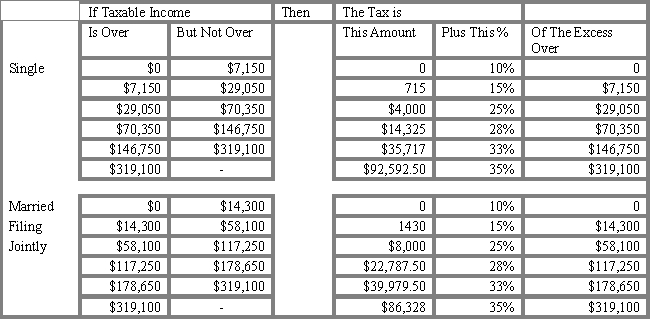

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the marginal tax rate for a single individual with taxable income of $85,000?

A) 15%

B) 25%

C) 28%

D) 33%

E) 35%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: It is not a good idea to

Q6: The third step of the portfolio management

Q7: _ gains are taxable and occur when

Q8: Return is the only important consideration when

Q9: You currently have $150,000 in an IRA

Q11: _ is an appropriate objective for investors

Q12: A study examining the performance of numerous

Q13: Suppose the 8 percent investment of the

Q14: Experts suggest life insurance coverage should be

Q15: Investing 30 to 40 percent of your